Stay up to Date on the Latest Trends

Is Your Chart of Accounts Ready for 2026? Why Travel & Meal Tracking Needs an Overhaul

If your accounting system still lumps all meals into one expense account and all travel into another, you're heading into 2026 with a problem. The OBBBA tax changes mean that different types of...

Read more

Don't Let Poor Documentation Cost You: IRS Requirements for Travel & Meal Deductions

A credit card statement showing a charge at a steakhouse doesn't prove you had a deductible business meal. It only proves you paid for something. That distinction matters and it's one the IRS takes...

Read more

Not All "Entertainment" Is Lost: How to Salvage Meal Deductions from Non-Deductible Events

What changed in 2018 and what it means for your business mealsIf you've been in business since 2018, you probably know that entertainment expenses are no longer deductible. What you might not know?...

Read more

NC Retailers: How the Penny Phase-Out Affects North Carolina Sales Tax on Cash Transactions

If you're a retailer in North Carolina, you've probably noticed pennies becoming harder to find. Following the U.S. Mint’s announcement in November 2025 that it has stopped producing pennies for...

Read more

Understanding Depreciation, Section 179, and Vehicle Limits

When you invest in equipment, vehicles, or other business assets, depreciation can be one of the most valuable tax tools available. But with different rules for Section 179, bonus depreciation, and...

Read more

The Hidden Value Most Small Business Owners Don’t Track

When small business owners think about contributions to their business, they usually think in terms of cash - money spent, money earned, money saved. But there’s another type of contribution that...

Read more

Refresh Your Finances: Fall into Smarter Tax Planning

As the leaves change and the year winds down, it's the perfect time to reflect and refresh your tax strategy. Embrace the season's theme of transformation with tax-loss harvesting—your financial...

Read more

To Build or Not to Build?

Real Estate Incentives That Fuel GrowthIf you’re thinking about designing, constructing, or purchasing property in 2026, now is the time to start planning. Several key tax incentives that reward...

Read more

Take Advantage of “Made in the USA” Tax Savings

If your business spends money improving products, processes, or software - good news! Recent tax law changes mean you could deduct more of your research and development (R&D) costs right away,...

Read more

Top 3 Bookkeeping Reports Every Business Owner Needs

Managing your business's finances often feels like navigating a stormy sea. However, by reviewing key bookkeeping reports regularly, you can chart a clear course. These reports not only identify...

Read more

Life Events Impacting Tax Status: Smart Moves

Life changes, such as marriage, divorce, or expanding your family, are often emotional milestones with practical tax implications. Understanding how these events affect your tax status can empower...

Read more

The One Big Beautiful Bill: What Small and Medium Businesses Need to Know

The One Big Beautiful Bill Act (OBBB) brings significant tax changes that could impact your business operations, employee benefits, and personal tax planning. As your trusted CPA firm, we've...

Read more

Act Fast: EV Tax Credits Expire September 30, 2025

Act Fast: EV Tax Credits Expire September 30, 2025If you're considering purchasing an electric vehicle (EV) for personal or business use, time is running out to take advantage of generous federal...

Read more

Best Identity Theft Protection Services for 2025: Features, Reviews & Tips

Identity theft affects millions of Americans every year—and it’s getting more sophisticated. One compromised password, one data breach at your bank, or one fake phone call from someone pretending...

Read more

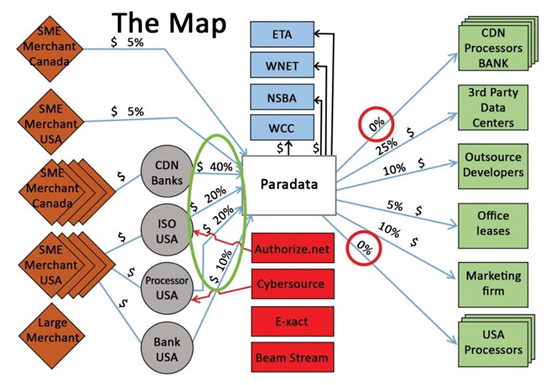

A Strategic Guide for Business Owners: Mapping Tariff Risk

Struggling with tariff uncertainty and its impact on your business, finances, and taxes? Discover how our coaching group leverages the powerful Market Map tool to bring clarity and control to your...

Read more

BOI Reporting Update: Treasury Suspends Enforcement for U.S. Companies

The U.S. Treasury Department has announced that it will not enforce Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act (CTA) for U.S. businesses....

Read more

How Close is Trump to Passing a New Tax Bill? A Deep Dive into the Current Legislative Landscape

In the whirlwind of U.S. politics, the Republicans are using the budget process to get Trump's priorities, including tax, in place early. With the House and the Senate each having passed their own...

Read more

BOI Reporting Update

The suspended Beneficial Ownership Information (BOI) reporting deadline under the Corporate Transparency Act (CTA) has been reinstated, requiring most companies to file by March 21, 2025. This...

Read more

Navigating a Challenging Tax Season: IRS Dismissing 6,700 Employees

This tax season may bring unprecedented challenges for taxpayers due to significant staffing reductions at the IRS. The agency recently announced it will dismiss 6,700 employees—roughly 6% of its...

Read more

When to Contact the IRS vs. an Accountant

When tax-related questions arise, many individuals and businesses wonder whether they should contact the IRS directly or seek assistance from an accountant. While the IRS provides official guidance...

Read more

Protect Yourself from Scam Emails

Tax season is a busy time for everyone, including scammers. Fraudulent emails targeting businesses and individuals are becoming increasingly sophisticated, making it critical to stay vigilant. We...

Read more

A Tale of Two Businesses: The Hidden Costs of Worker Misclassification

This week, the IRS released Rev. Proc. 2025-10, which sets out criteria to get out of trouble when a business incorrectly classifies and employee as a contractor instead. We are reminded of the...

Read more

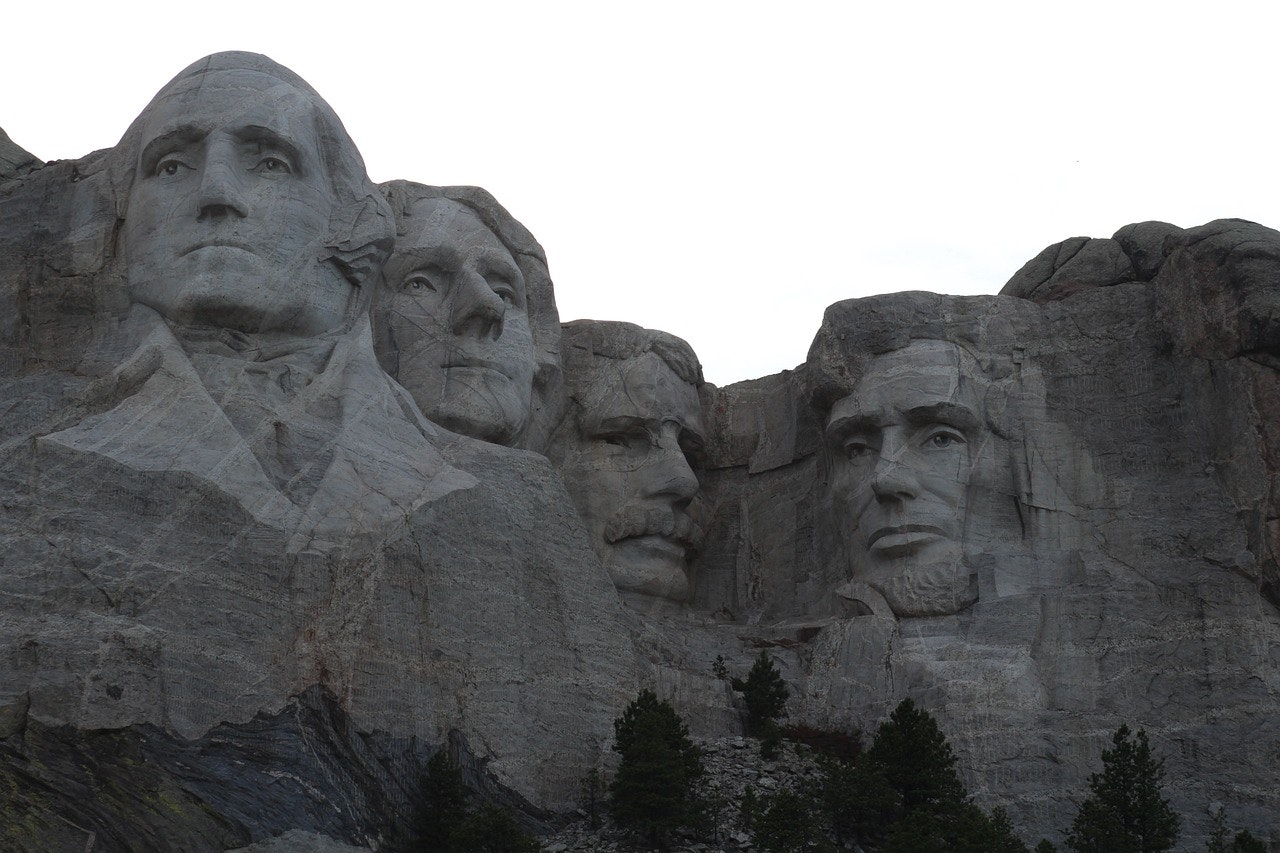

Comparing the 2024 Presidential Candidates’ Tax Plans

With the 2024 election approaching, the tax policies proposed by Kamala Harris and Donald Trump highlight two very different visions for the U.S. economy. Here’s a breakdown of each candidate's tax...

Read more

Tax Relief and Financial Assistance for Those Affected by Hurricane Helene

If you or someone you know has been impacted by Hurricane Helene, we want to make sure you're aware of the financial relief options available. From tax breaks to federal assistance and deadline...

Read more

Important Tax Deadline Extensions Due to Hurricanes Debbie and Helene

The Internal Revenue Service (IRS) has announced significant tax relief measures for taxpayers affected by Hurricane Debby and Hurricane Helene. This blog post summarizes the key details of these...

Read more

Watch Out: DOL Adding Auditors to the Wage & Hour Division

The U.S. Department of Labor is set to expand its enforcement team across the nation.Announced Thursday, February 24th, the U.S. Department of Labor revealed that it is looking to add 100...

Read more

Superseding Return: A Super Solution To IRS Delays

Supersede (verb): to take the place of or replace. A do-over. The IRS suffers from its historic backlog of unprocessed filings and personnel shortages. But, this is not stopping them from placing...

Read more

How Your Assumed Business Name Might Be a Problem

“What's in a name?”As a business owner, new or otherwise, you know that choosing the right company name is a crucial (and sometimes nerve-racking) step toward establishing yourself. Along your...

Read more

3 Simple Tools to Meet Your 2022 Finance Goals

A new year finds many of us with the motivation to take stock, buckle down, and make improvements in our lives. Getting your financial fitness in check this year should be at the top of your...

Read more

Important Tax Dates & Deadlines

Updated for the tax year 2021.OverviewThe IRS has outlined important tax deadlines in this calendar. Dates and details are listed below for your convenience. Make sure you add pertinent dates to...

Read more

Are You Missing Out On Unclaimed Funds?

Let the treasure hunt begin. Yes, you could be owed money by the State or US Government and not know about it. Let’s find it!Money Owed to Me, How? Yes, unclaimed money or unclaimed funds are held...

Read more

2021 Tax Planning: Retirement Savings for Individuals

It is always a good time to review and evaluate your retirement savings. The tax code provides significant incentives for contributions made to traditional and Roth IRA’s, as well as to employer...

Read more

How a Business Framework Can Change Your Life

No great business stands still for long. And if you do, you’re likely to end up on life support, coasting through and failing to grow or make profits. Or even worse, experiencing disruption over a...

Read more

A Tax Strategy for Gain On The Sale Of Your Home

Will I Be Taxed On The Sale Of My Home? Tax Strategy No. 116: Exclusion of gain on sale of your home – full and prorated exclusion. Have you noticed the housing market boom? It is wild here in the...

Read more

SBA Changes Forgiveness Process on Loans of $150,000 or Less

New InitiativeOn July 28, 2021, the Small Business Administration decided to allow PPP borrowers with loans of $150,000 or less to apply for forgiveness online.Under this new initiative, the...

Read more

2021 Tax Planning: Charitable Giving

You probably know that you can get an income tax deduction for a gift to a charity if you itemize your deductions. But there is a lot more to charitable giving. We would like to take the...

Read more

Shannon Susko Releases Metronomics

METRONOMICS by Shannon Susko has arrived!Are you having FUN as a CEO? Are you happy to come to work and happy to leave at the end of the day? You don’t have to sacrifice the life you want to get...

Read more

SB 116 Amendment and Vote

June 4th Update:The House passed SB 116 by a vote of 71-36 today. The split was mostly along party lines; seven Democrats broke ranks and voted in favor. Debate on the bill was spirited and focused...

Read more

PPP Expense Deductibility Tax Proposal

On Tuesday, May 25th, the Senate Finance Committee co-chairs unveiled a sweeping tax proposal. The 41-page amendment rewrites HB 334. There has not been a vote on the proposal yet.Instead of...

Read more

What We Know About the PPP Expense Deductibility Bill

Senate leaders remain opposed to adopting the House version of the HB 334, but an alternative proposal is on the horizon. Following the tumultuous back and forth, here is the latest news about the...

Read more

North Carolina House Fast-Tracks PPP Deductibility

Updated April 30th, 2021The North Carolina House of Representatives approved legislation that would align the state tax code with two recent federal tax changes.The House was expected to adopt HB...

Read more

New Business Meal Tax Provision

The recent stimulus legislation included an important provision. This provision removes the 50% limit on deducting business meals provided by restaurants in 2021 and 2022. Which makes those meals...

Read more

Which Business Structure is the Best Fit for You?

Starting your own business is thrilling, not to mention liberating. You become your own boss, do what you love, and make money while doing it. Once you have your product or service solidified,...

Read more

7 Tips on How to Hire and Keep Top Performers

Hiring the right talent is one of the most crucial elements of managing your business. When you want to grow and expand the skill set of your workforce, it’s vital that you hire the right people...

Read more

Start a Business from Scratch in 10 Steps

Thinking of taking the plunge into entrepreneurship? You’re not the only one. The Wall Street Journal reports the number of people starting their own businesses in the US surged to a 13-year high...

Read more